Abstract

In the rapidly evolving landscape of decentralized exchanges (DEXs), the leading protocols offering self-custodial, permissionless and decentralized trading solutions to crypto traders have seen remarkable growth in recent years. Yet, it has not been without challenges.

Amid this growth, liquidity fragmentation and limitations on multichain trading have led to inefficiencies and increased user costs, limiting the full capacity of DEXs for optimal performance. ApeX Omni, a new product line designed by ApeX Protocol, steps in with a practical solution: an aggregated multichain liquidity trading framework built on a modular, intent-centric architecture. Engineered with a focus on user needs, it offers a cost-effective alternative and a seamless multichain trading interface akin to centralized trading platforms, with the roadmap including the introduction of a spot trading platform, pre-market trading for perpetual pairs, community vaults for liquidity provision, and a social trading platform enabled by Soul Bound Tokens (SBTs).

Current Market Dynamics

The DeFi ecosystem has experienced significant expansion, with total value locked across various protocols reaching approximately $94.91 billion (at the time of writing). This growth is largely attributed to the emergence of DEXs, enabling users to execute transactions without reliance on central authorities.

The DEX landscape has witnessed remarkable growth, with trading volumes surpassing $970 billion in 2023, underscoring the increasing user adoption and investor interest in decentralized trading platforms. This momentum has persisted into 2024, with DEX adoption continuing to climb steadily.

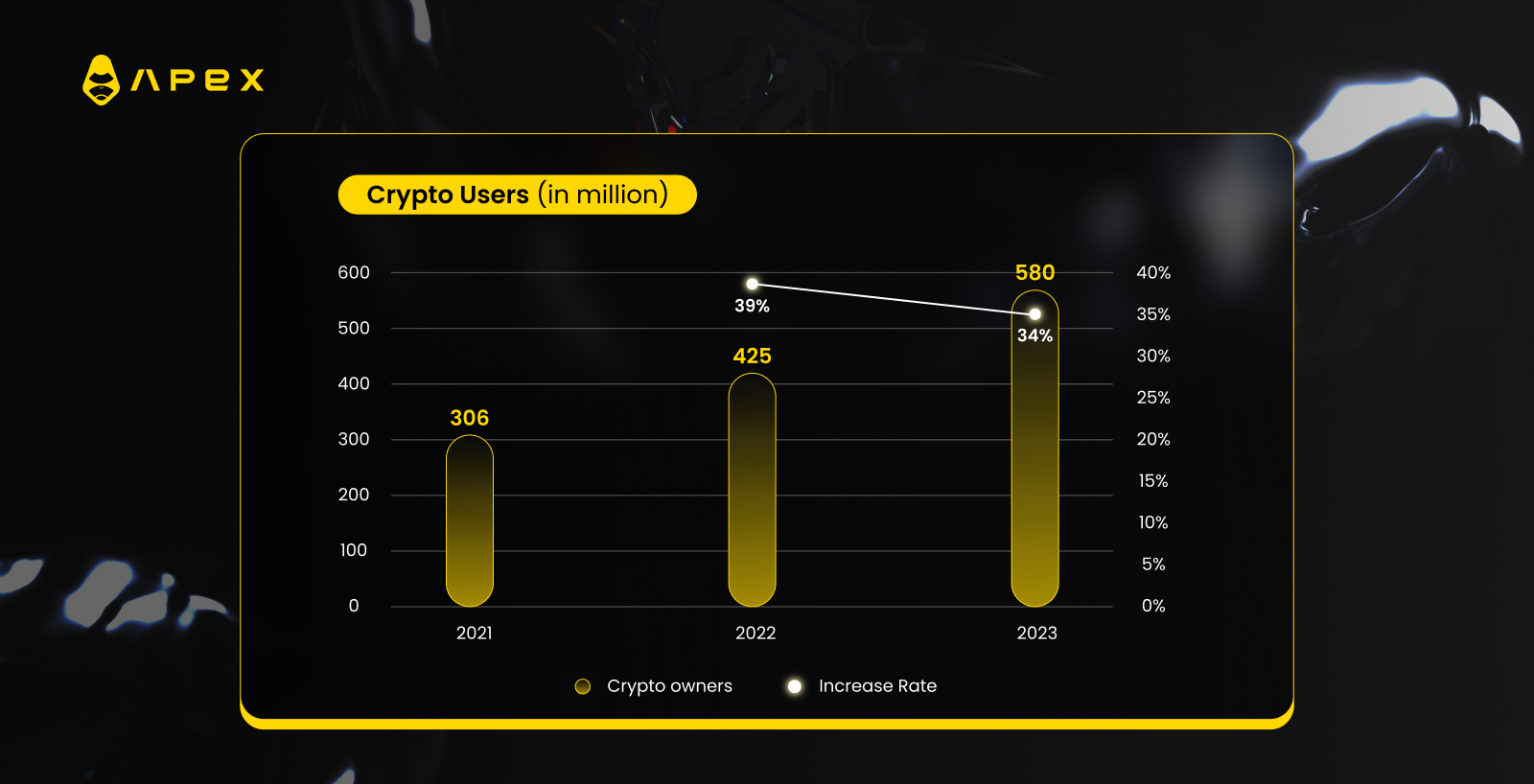

According to Crypto.com's research spanning from 2021 to 2023, the global count of crypto owners surged by 39% in 2022, jumping from 306 million in January to 425 million by December. This trend continued in 2023, with a 34% increase, reaching 580 million by December.

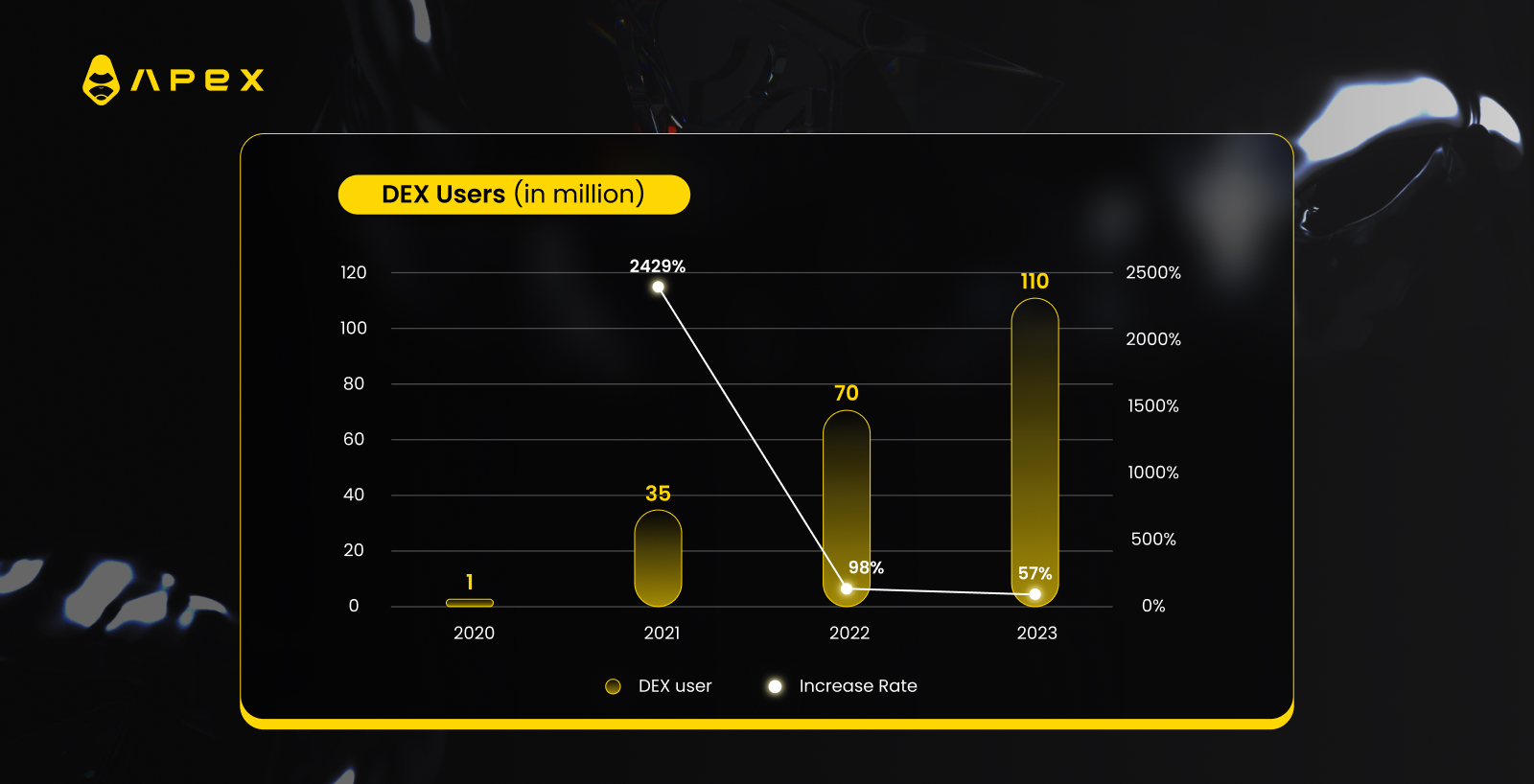

Comparing this growth trajectory with the rising adoption of decentralized projects, particularly the surge in DEX users, we observe a gradual shift towards decentralized platforms. Between 2021 and 2022, DEX users doubled from 35 million to 70 million, and from 2022 to 2023, they grew from 70 million to 110 million.

Notably, in this thriving ecosystem, several standout projects have garnered attention for their robust architecture, boasting high throughput rates, effectively reducing transaction costs, catering to customized trading needs, and implementing innovative incentive systems. Such developments underscore the evolving nature of the decentralized exchange space and highlight the importance of adaptable solutions in meeting the diverse demands of users and investors alike.

Limitations of Current Models

While the DEX landscape has experienced significant expansion and innovation, it is not without its challenges. A number of shortcomings and constraints present in the current DEX models, such as liquidity fragmentation and lack of multichain trading opportunities, require improvement to foster a more efficient and user-friendly decentralized trading environment.

Liquidity Fragmentation

Liquidity fragmentation within DEXs poses a significant challenge, impacting market efficiency and user experience. In DeFi, liquidity plays a pivotal role in enabling smooth and efficient asset exchange. Due to liquidity fragmentation, DEX traders need to navigate multi-chain asset management, leading to complexities and inefficiencies in capital allocation. As a result, they face hurdles in optimizing their strategies and may experience sub-optimal outcomes due to fragmented liquidity pools.

As the Web3 landscape continues to grow, the issue of liquidity fragmentation remains critical, as it inhibits efficient trading and asset transfer within the decentralized ecosystem. Between 2019 and 2024, a notable surge in blockchain technology was observed, with a substantial increase in the number of new blockchains introduced. Over the five-year period, the count rose steadily, starting at 10 in 2019 and steadily climbing to 274 by 2024. This represents a significant growth trajectory, indicating the expanding landscape and adoption.

However, with the emergence of multiple blockchain networks with limited interoperability between them, where each is governed by unique consensus rules and protocols, there is a growing demand for an infrastructure that will enable connectivity and provide users with a unified user interface that abstracts away the complexities of multichain operations.

Limited Multichain Trading Possibilities

The second prevalent issue within space is the limited scope for multichain trading opportunities.

Despite users' assets being distributed across various blockchain ecosystems, most DEXs are confined to operating solely within a single chain. This limitation imposes significant challenges as it hinders DEX's ability to cater to fully multi-chain trading requirements comprehensively. Consequently, users are left with no option but to manage assets across multiple chains, leading to capital inefficiencies.

Moreover, the necessity of switching between multiple DEXs across different blockchains entails cumbersome processes such as token wrapping and bridging to render digital assets tradable on alternative platforms. These complexities result in elevated costs, restricted trading options, and diminished gains for users, underscoring the need for a more seamless and integrated multichain trading infrastructure within the DEX ecosystem.

Addressing Challenges

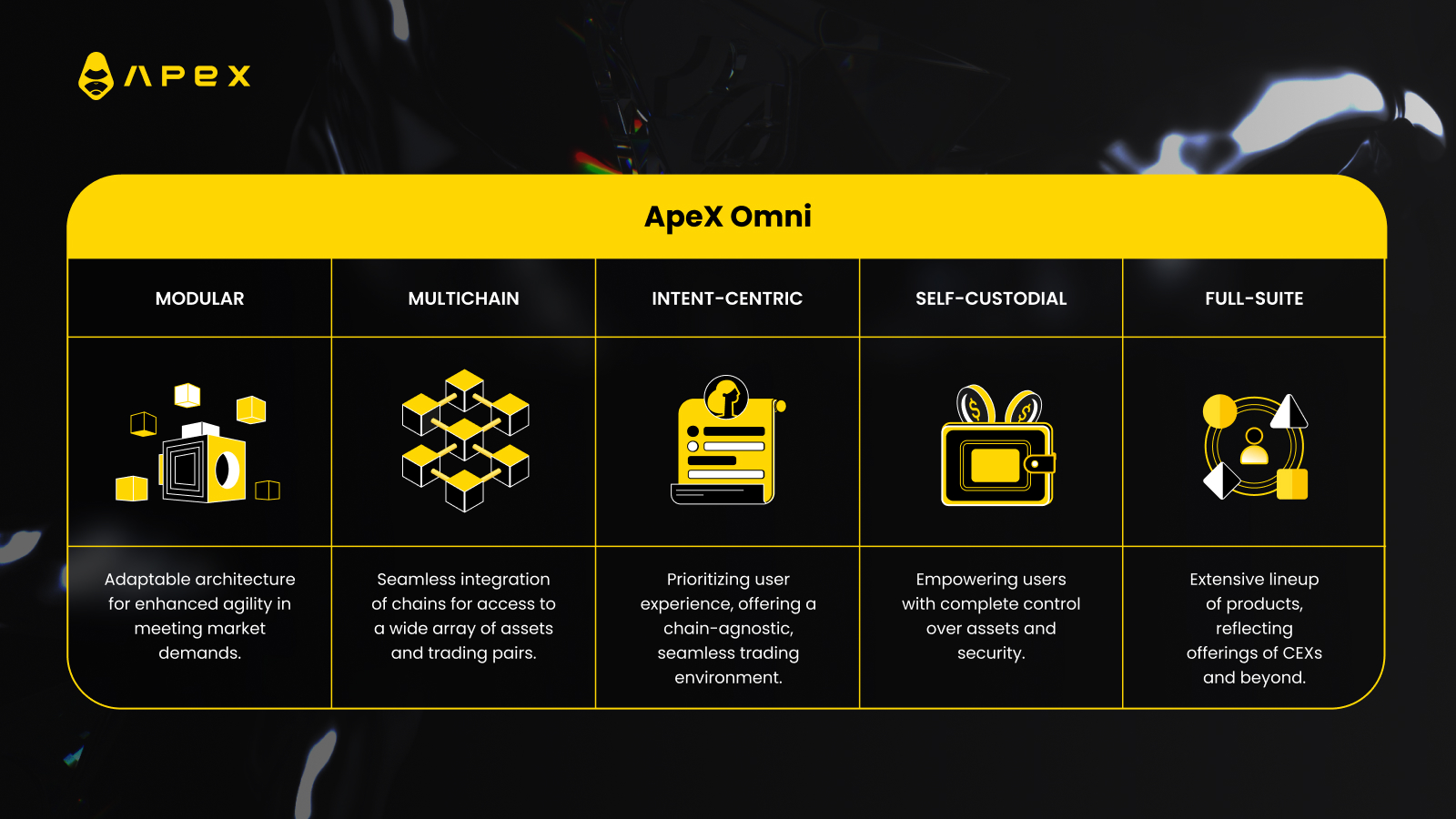

In response to these challenges, we've developed ApeX Omni.ApeX Omni stands as a modular, multichain liquidity trading infrastructure, offering a highly efficient decentralized trading experience with rich liquidity and a diverse range of trading products.

At its core, ApeX Omni provides an intent-centric experience, dedicated to addressing the precise needs of users. This approach is reflected in our full-product lineup DEX, designed to mirror the convenience and variety typically associated with centralized exchanges.

ApeX Omni

ApeX Omni is set to redefine the decentralized trading landscape with:

Modular Design for Flexibility: The modular design of ApeX Omni infrastructure ensures flexibility and adaptability, enabling enhanced agility to better meet market demands and promptly roll out products that empower users to optimize their strategies and maximize returns.

Multichain Liquidity Aggregation: ApeX Omni seamlessly aggregates liquidity from multiple blockchain networks, providing users with access to a vast pool of assets and trading pairs across diverse ecosystems. Utilizing the zk-link engine, Omni gains access to and lists native tokens across connected L1s and L2s. This enables users to trade multi-chain assets seamlessly through a unified interface, eliminating the need for cross-chain asset bridges and mitigating associated risks and fees.

Intent-Centric Approach: ApeX Omni introduces an intent-centric DEX designed to mirror the convenience and versatility offered by centralized exchanges. This user-centric approach prioritizes the seamless fulfillment of traders' needs and preferences, providing them with a chain agnostic trading experience, seamlessly across multiple blockchain networks.

Comprehensive Product Lineup: From spot trading and liquidity provision to derivatives and social trading, ApeX Omni offers a comprehensive matrix of trading products tailored to meet the diverse requirements of users across the decentralized ecosystem.

User Self-Custody: ApeX Omni prioritizes user self-custody, empowering users with full control over their assets and funds in one unified interface. By adopting a decentralized approach to custody, ApeX Omni enhances security and transparency, ensuring that users can trade with confidence and peace of mind. It enables effortless management of multi-chain token portfolios through a single wallet, streamlining the user experience.

ApeX Omni Architecture

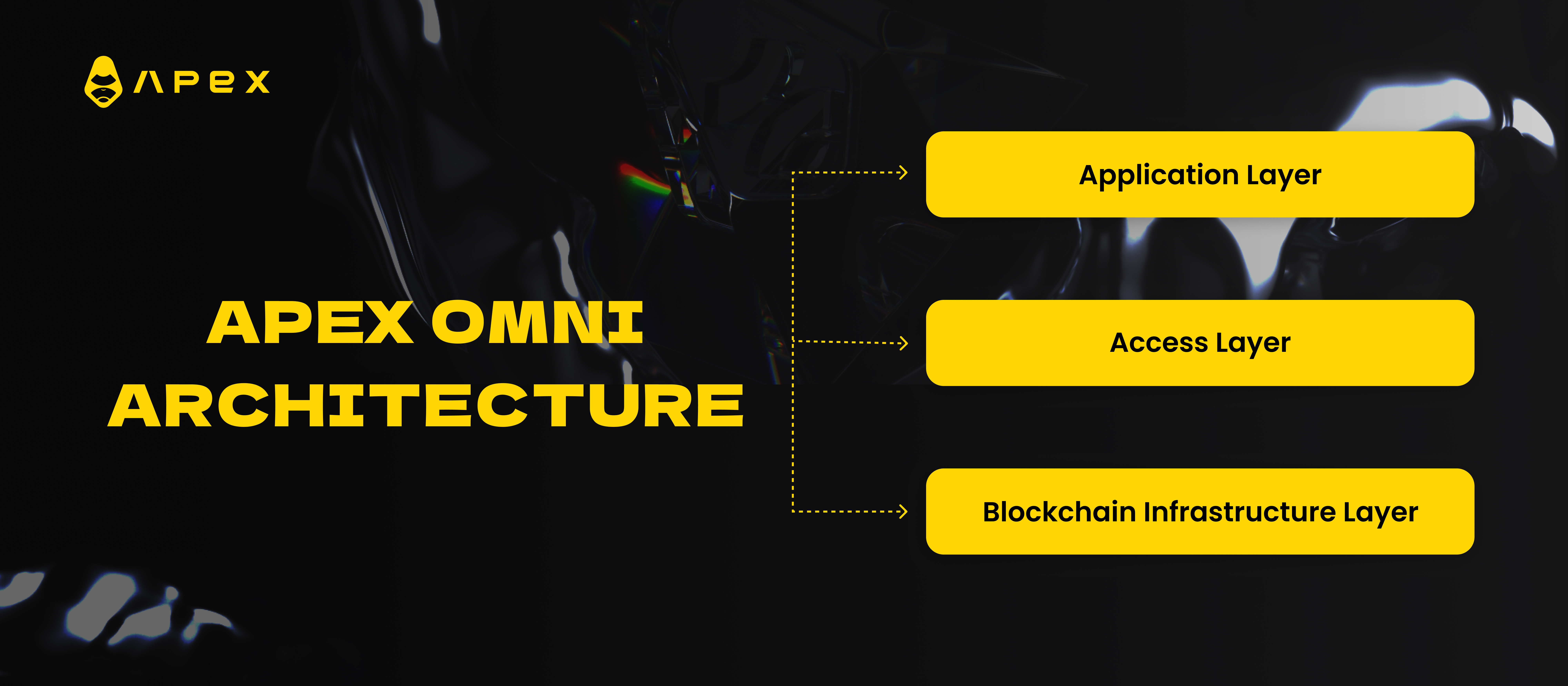

ApeX Omni operates on modular, multichain, intent-driven infrastructure enabling seamless synchronization of multi-chain native tokens, enhancing scalability and flexibility, reducing fees, and ensuring the security of assets by zero-knowledge proofs. As displayed on the diagram below, the modular infrastructure of ApeX Omni consists of 3 (three) distinct layers: Access Layer, Application Layer and Blockchain Layer:

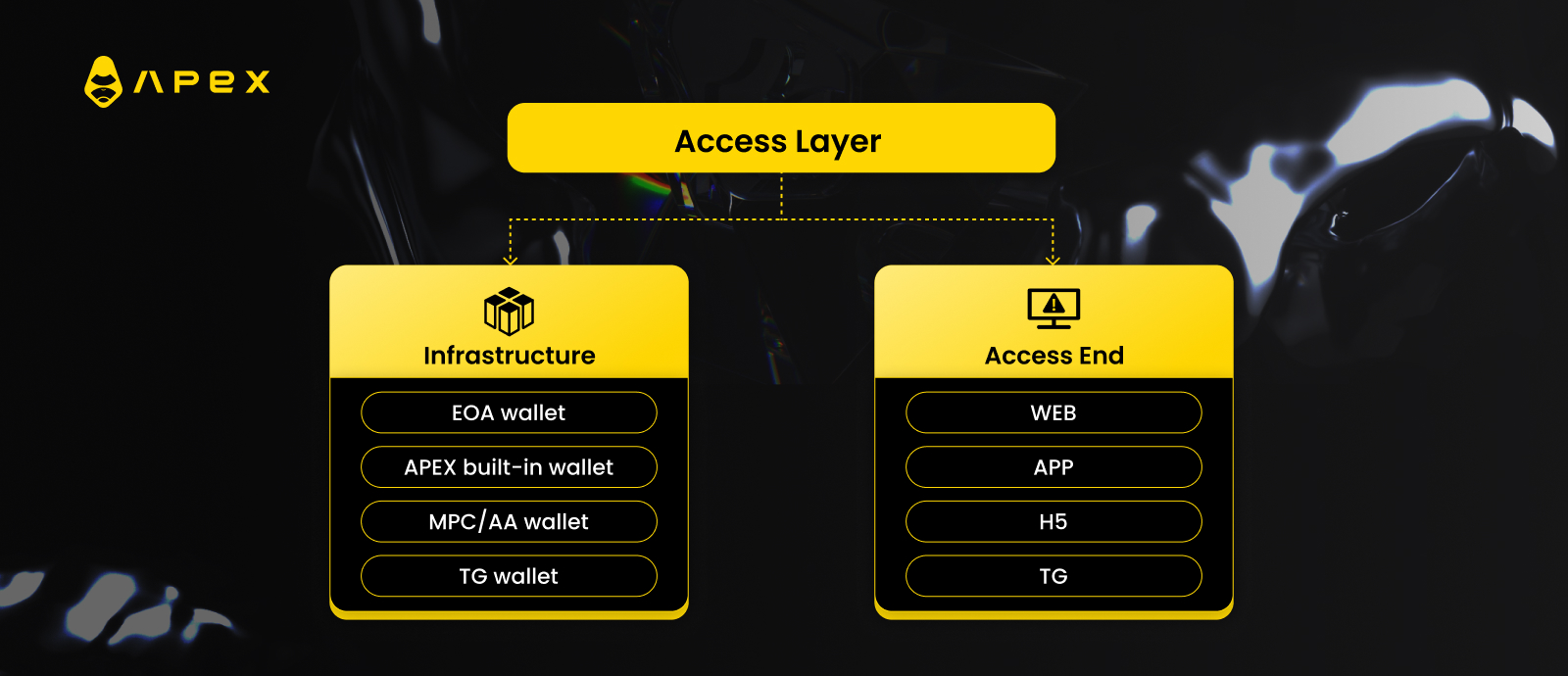

Access Layer: This layer is a frontend infra that users interact with. It manages user access to ApeX from across a range of platforms, including ApeX web, mobile apps, H5, and Telegram, along with other essential applications and wallet infrastructures needed for seamless interaction. Users have the flexibility to employ diverse wallet types such as EOA, AA, MPC wallets, or potentially utilize ApeX built-in wallets, or Telegram built-in wallets. Moreover, users can directly access the platform via API, enhancing accessibility and usability.

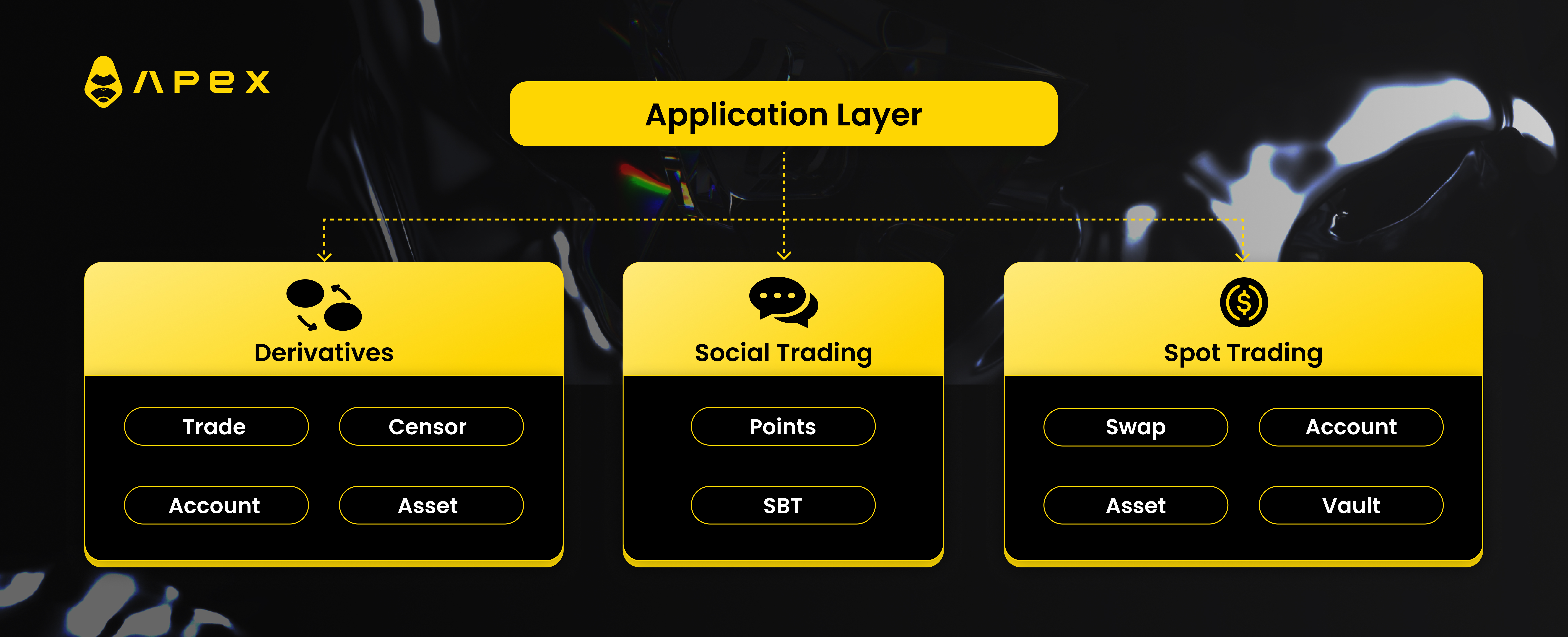

Application Layer: This layer comprises a diverse range of applications offered by ApeX Omni, catering to various user needs and preferences. Key applications within this layer include spot and derivatives trading platforms, social trading features, staking programs, community vaults, and other specialized functionalities designed to enhance the user experience and meet the demands of the DeFi ecosystem.

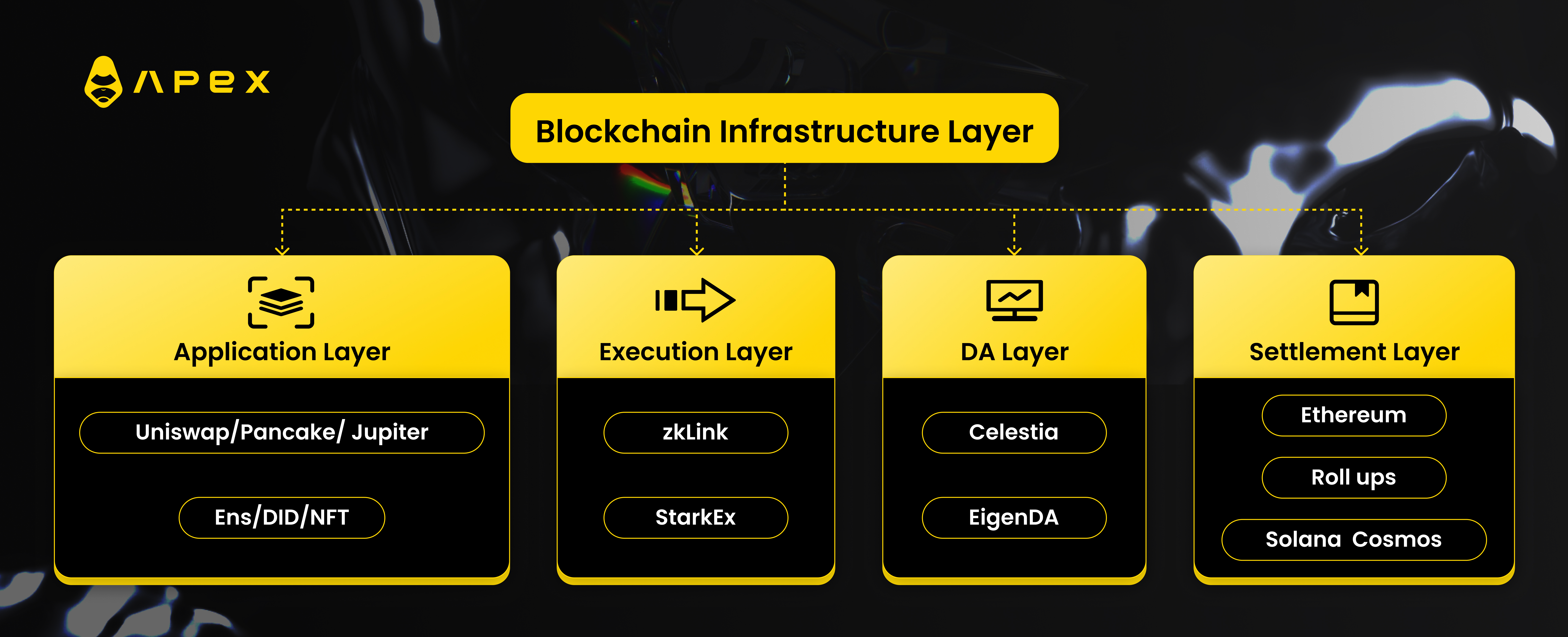

Blockchain Layer: This foundational layer encompasses the blockchain infrastructure that supports ApeX Omni, facilitating the utilization and implementation of various applications. It comprises several components:

Settlement Layer: Primarily composed of various public blockchain networks, the settlement layer provides proof verification and is where the transactions of ApeX applications are finalized and recorded.

Data Availability Layer: This layer stores various transactions related information generated by ApeX applications. Data pertaining to transactions and user interactions are stored and made available within the access layer for retrieval and verification.

Execution Layer: Responsible for executing transactions and generating settlement proofs, the execution layer ensures the seamless operation of ApeX applications. It processes transactions efficiently and provides the necessary verification mechanisms to validate transaction outcomes. As an execution layer, ApeX Omni leverages the zkLink engine.

Blockchain Application Layer: This layer integrates various DeFi protocols within the ApeX ecosystem. It encompasses a diverse range of functionalities, including DEXs, social trading features, and support for Ethereum Name Service (ENS), Digital Identities (DIDs), and Non-Fungible Tokens (NFTs), among others.

Through this architecture, ApeX Omni is able to consolidate liquidity across various blockchain networks, pooling native crypto assets into a unified trading platform, effectively addressing liquidity fragmentation and limited multichain trading issues. Simultaneously, ApeX Omni allows for agility and continual enhancement of the product suite through modular, scalable infrastructure, thereby reducing costs, enhancing capital efficiency and improving user experience, while, at the same time, prioritizing security with zero-knowledge proof technology.

This foundational framework enables ApeX Omni to deliver a user experience akin to centralized trading platforms, offering an extensive array of trading products while maintaining robust security, low-cost and seamless interoperability across different networks.

Product Roadmap

ApeX Omni introduces a suite of innovative products set to redefine user experience in DeFi:

Derivatives: A wide range of derivative products will be offered on ApeX Omni designed to help you hedge risk, speculate on price movements, and maximize your trading potential.

Spot Offering: ApeX Omni simplifies spot asset trading by allowing users to deposit USDT and participate in trading across various chains. Eliminating the complexities of chain-specific requirements, gas fees, and trading route differences, traders will enjoy streamlined and effortless trading across various chains.

Pre-Market Trading: ApeX Omni introduces the pre-market trading feature, where participants can trade assets before their official launch/listing. This will give DEX traders the opportunity to hedge early or capitalize on emerging market trends.

Community Vaults: ApeX Omni's democratized liquidity pools are set to unlock enhanced passive income opportunities for DeFi users and greater earning potential as an ApeX's governance token, $APEX, holder.

Social Trading: Last but not the least, ApeX Omni aims to establish a gateway to decentralized social trading in Web3. Gain access to first hand trading insights, follow top traders' strategies, and earn rewards through our innovative ApeX Social framework and amplify your earnings via Omni points system — ApeX Social Points. At the heart of this program, ApeX's Soulbound Tokens, also known as ApeSoul, will empower traders with full control over their assets and trading activities, creating a transparent and straightforward framework for all participants.

Closing Thoughts

ApeX Omni is poised to redefine the DeFi landscape through its modular, multichain, and intent-centric architecture. By unlocking the full potential of DEXs with enhanced liquidity, a broader range of trading tools and products, increased passive earnings potential, and enriched social features, ApeX Omni stands ready to lead the charge in shaping the future of decentralized finance.