Perpetual trading has emerged as a significant concept in the world of financial trading, particularly in the cryptocurrency market. This innovative trading mechanism combines elements of traditional futures contracts with the flexibility and continuous nature that many modern traders seek. Understanding how perpetual trading works and how it differs from spot trading is crucial for anyone looking to navigate this space effectively.

Introducing Perpetual Trading

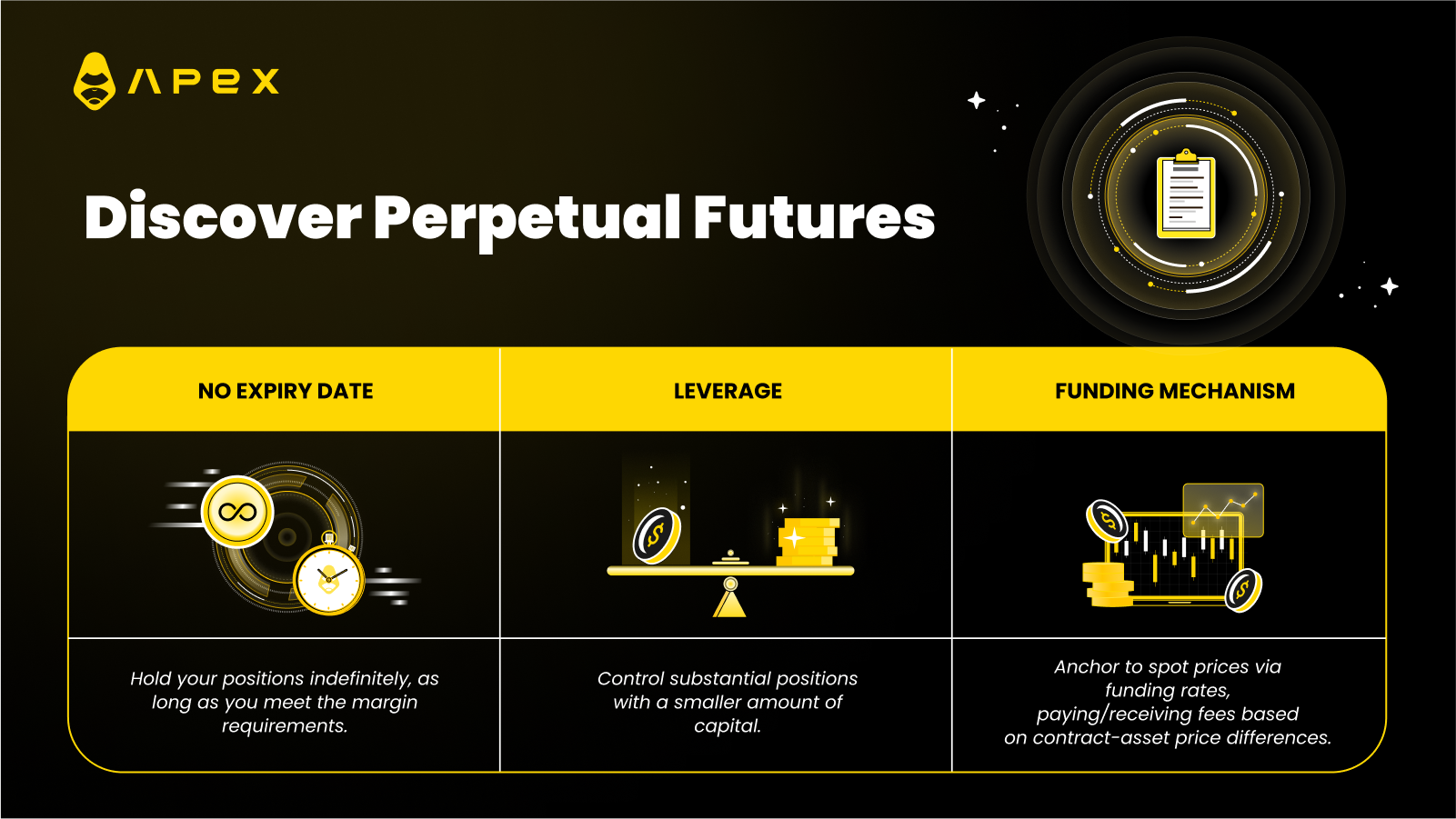

Perpetual contracts, often associated with cryptocurrency exchanges, are a type of derivatives product that, like futures contracts, allow traders to speculate on the future price of an asset. However, unlike traditional futures, perpetual contracts do not have an expiration date. This means that a trader can hold a position indefinitely, provided they have sufficient margin to support their position.

The key feature of perpetual contracts is that they are designed to mimic a spot market but with the added advantage of leverage. Traders can amplify their exposure to price movements without needing the full capital typically required in a spot market. While leverage can amplify profits, it can also increase the risk of significant losses.

Differences between Perpetuals and Spot Trading

To appreciate the uniqueness of perpetual trading, it's essential to understand how it differs from spot trading:

Immediate Settlement vs. Indefinite Holding Period

In spot trading, the transaction involves the immediate purchase or sale of an asset. For example, if a company buys barrels of crude oil in the spot market, they pay and receive the oil immediately at the current market price. In contrast, perpetual contracts allow traders to speculate on the price of an asset without an immediate exchange of the asset itself. Traders can hold their positions as long as they maintain an adequate margin.

Leverage and Margin

Spot trading can involve leverage, but it usually entails borrowing funds from a financial institution and paying interest on the loan. In perpetual trading, leverage is an integral part of the contract. Traders can control large positions with a relatively small amount of capital (margin). This margin acts as a security for the position and must be maintained to keep the position open.

Funding Mechanism

A unique aspect of perpetual contracts is the funding mechanism. To ensure that the price of the perpetual contract remains anchored to the spot price, traders either pay or receive funding periodically. This funding rate is adjusted based on the difference between the perpetual contract price and the spot price, reflecting market sentiment and cost of holding the position.

Perpetual trading offers a blend of the characteristics of spot and futures trading, providing traders with a tool to speculate on price movements without a defined expiry date.

It’s particularly appealing in fast-moving markets like cryptocurrencies, where traders value flexibility and the ability to react quickly to market changes. As with any leveraged financial instrument, the potential for high returns comes with a corresponding risk level. Traders must approach perpetual trading with a clear understanding of these risks and a robust risk management strategy.