The grid bot on ApeX offers a robust solution for automating your trading, automatically executing long and short positions on perpetual contracts to optimize profits in the volatile 24/7 crypto market.

These automated strategies performed by the grid bot execute long and short positions at predetermined intervals within a defined price range. They aim to leverage price fluctuations and capitalize on volatile market conditions.

ApeX Grid Bot offers three (3) options — Long, Short, and Neutral — for placing orders. Additionally, it allows users to set the strategy on arithmetic or geometric settings. Let's explore how each type operates.

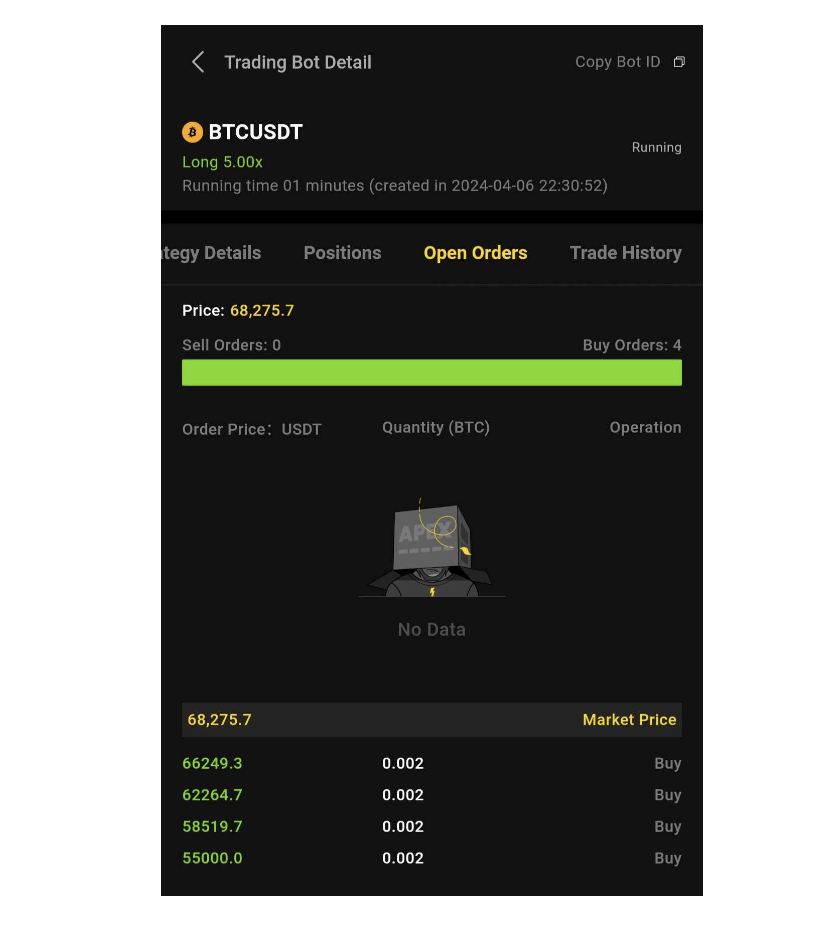

Long Position with Geometric Mode

The long mode is best suited for fluctuating markets, when prices are on the rise. Meanwhile, in geometric mode, each grid maintains an equal price difference ratio. For instance, if the interval is 2%, the price of the subsequent order will be 2% higher than the previous price.

Example

Suppose Alice sets up a grid bot strategy on BTC-USDT with the following parameters, when the market price is at 68,267.9 USDT:

Upper Range: 75,000 USDT

Lower Range: 55,000 USDT

Number of Grids: 5

Grid Mode: Geometric

Leverage: 5x

Intervals: 6.399% ≈ [(75,000/55,000)^(1/5)]–1

The price for each grid will automatically be computed and Alice's orders will be placed with 5x leverage. Once the strategy is deployed, in "Open Orders", Alice will be able to find the order details as well as the open positions created.

Please Note: The long bot calculates prices from the lower range of the grid. Consequently, the interval percentage, in this case — 6.399%, will be applied upwards from every subsequent grid (e.g. $55,000 + 6.399% = $58,519.7).

As Alice has set the bot range between 55,000 USDT and 75,000 USDT, her bot will strictly operate within these bounds, with each grid closing after a gain of 6.399%. Should the price reach 75,000 USDT, the sell order will be executed, while a buy order will be placed at 68,275.7 USDT. Conversely, if the price retraces to 62,249.3 USDT, the buy order at 62,249.3 USDT will be filled, and a sell order will be placed at 66,249.3

When the price goes beyond the configured range, Alice can opt to either close the strategy entirely or wait for the market price to return to the preset range. If the bot is closed, all pending orders will be canceled, and positions will be closed at the prevailing market price, with assets automatically credited to her ApeX Pro sub-account.

Please note that this example does not utilize the "Open on Creation" feature. When this feature is enabled, the bot will fill a group of grids as a market order (grids that are beyond the market price during the creation of the bot). Following these initial fills, the bot will close these open positions once the predetermined prices are reached and take profit.

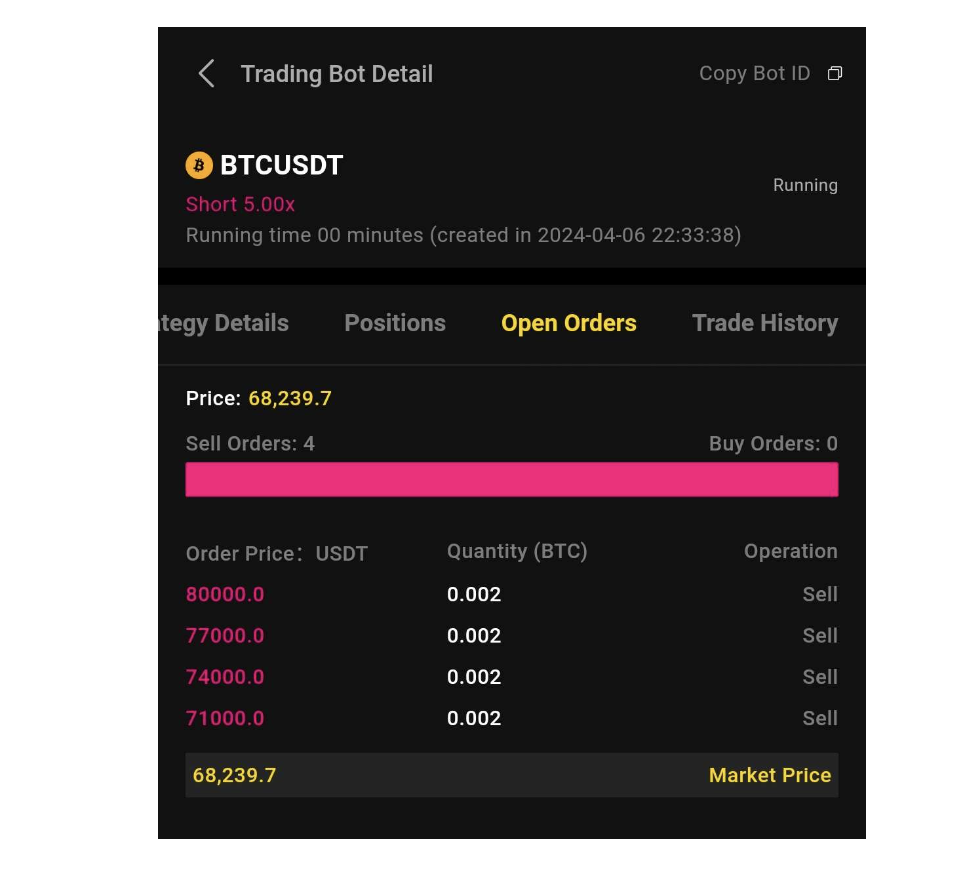

Short Position with Arithmetic Mode

The short mode is ideal for markets experiencing downward price trends. Short grids initiate short positions at market prices upon creation and secure profits by closing these positions when prices decline.

In arithmetic mode, each grid maintains an identical price difference. For instance, if the interval is 5,000 USDT, the price of the subsequent order will be 5,000 USDT higher than the previous price.

Example

Suppose Bob sets up a grid bot strategy on BTC-USDT with the following parameters, when the market price is at 68,219.8 USDT:

Upper Range: 80,000 USDT

Lower Range: 65,000 USDT

Number of Grids: 5

Grid Mode: Arithmetic

Leverage: 5x

Intervals: 3,000 = (80,000 − 65,000)/5

The price for each grid will automatically be computed and Bob's orders will be created with 5x leverage. Once the strategy is deployed, the positions will be placed in the following manner.

As Bob has set the bot range between 65,000 USDT and 80,000 USDT, his bot will strictly operate within these bounds, with the sell orders placed at every 3,000 USDT interval and each grid closing after a price gain of 3,000 USDT.

Should the price reach 74,000 USDT, the buy order will be executed at 74,000 USDT, while a sell order will be placed at 71,000 USDT. Conversely, if the price drops to 68,219.8 USDT, the sell order at 71,000 USDT will be initiated, and a buy order will be placed at 68,219.8.

When the price goes beyond the configured range, no new orders will be initiated. Bob can opt to either close the strategy entirely or wait for the market price to return to the preset range. If the bot is closed, all pending orders will be canceled, and positions will be closed at the prevailing market price, with assets automatically credited to his ApeX Pro sub account.

Please note that this example does not utilize the "Open on Creation" feature. When this feature is enabled, the bot will fill a group of grids as a market order (grids that are beyond the market price during the creation of the bot). Following these initial fills, the bot will close these open positions once the predetermined prices are reached.

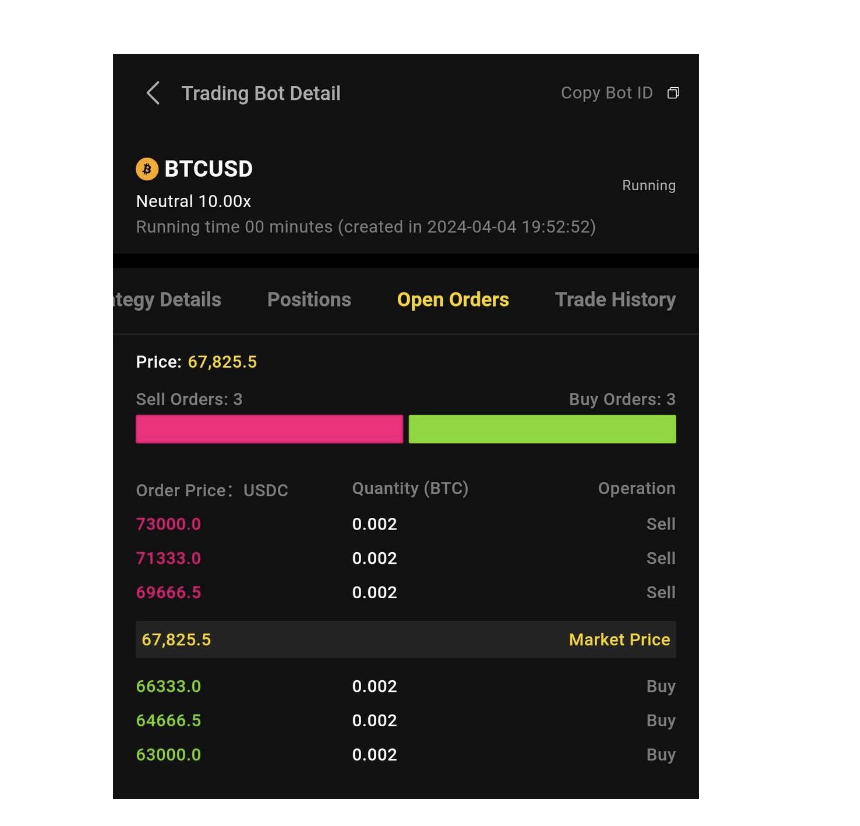

Neutral Position

In neutral mode, the strategy does not start with any initial position. The bot will only initiate long orders below the base price and short orders above the base price. Once the market price reaches the predetermined price, the long or short position will be activated, depending on which order direction is executed.

Example

Suppose Eve creates a grid bot strategy on BTC-USDT with the following parameters, when the market price is at 67,825 USDT:

Upper Range: 73,000 USDT

Lower Range: 63,000 USDT

Number of Grids: 6

Grid Mode: Arithmetic

Leverage: 5x

Intervals: 1,666.5= (73,000− 63,000)/6

Remember, in arithmetic mode, each grid maintains an identical price difference. For instance, in our example, as the interval is 1,666.5 USDT, the price of the subsequent order will be 1,666.5 USDT higher than the previous price. The price for each grid will automatically be computed and Eve's orders will be created with 5x leverage. Once the strategy is deployed, the positions will be placed in the following manner.

When the BTC price reaches 66,333 USDT, the long position will be activated, and a short order at 69,666.5 USDT will be placed on the next grid. As the price climbs to 69,666.5 USDT, a short order will be executed, closing the long position, and initiating a new long order at 66,333 USDT. This completes a grid trade, generating profits from the price fluctuation.

As Eve has set the bot range between 63,000 USDT and 73,000 USDT, her bot will strictly operate within these bounds. Should the price exceed 73,000 USDT or drop below 63,000 USDT, no new orders will be initiated, but the position will remain open if no stop loss is set.

When the price goes beyond the configured range, Eve can opt to either close the strategy entirely or wait for the market price to return to the preset range. If the bot is closed, all pending orders will be canceled, and positions will be closed at the prevailing market price, with assets automatically credited to her grid bot sub-account.

Now that you better understand how to place orders using ApeX Grid Bot, this tool will offer you a powerful way to automate your trades! Deploy grid bot on ApeX and execute long, short and neutral strategies with either geometric or arithmetic settings, to capitalize on market movements.

Remember, we're in the midst of ApeX Grid Bot Showdown! Don't miss out on negative maker fees of 0.002%, and a 10,000 USDT prize pool! For all the details: https://www.apex.exchange/blog/detail/Grid-Bot-Showdown

Go ahead and activate ApeX Grid Bot and join in on the fun: https://pro.apex.exchange/gridBot