We're thrilled to introduce Staking 3.0 on ApeX, an upgraded version of our existing staking program.

The ApeX Staking Program, supporting $APEX and $esAPEX pools, serves as a passive income generation mechanism, enabling ApeXers to earn additional income in USDC by sharing ApeX Protocol revenues generated from trading fees on ApeX Pro.

The upgrade, scheduled to launch on March 7, 2024, introduces Locked Staking — staking with a lock-up mechanism that allows you to commit your tokens to respective staking pools for extended periods of time, leading to a higher APY and increased earnings.

The implementation of the lock-up feature aims to enhance our Staking Program by not only offering higher yields to you but also by creating a framework for increased stability and enhanced value for the $APEX token, which is paramount for the sustained growth of our project.

Getting Started with Staking 3.0

Let's explore everything you need to know about Staking 3.0!

As noted above, the Locked Staking allows you to commit your $APEX or $esAPEX tokens in respective pools for fixed durations*. For increased flexibility, we offer 4 different time frames that you can choose from to lock-in your holdings: 3 months, 6 months, 12 months, or 24 months.

Choose the term according to your preferences, based on your overall investment strategy. However, needless to say, the longer you lock-in your tokens, the higher your APY will be!

Calculating Your Rewards

With Locked Staking, the dynamic reward calculation for the Staking Program is slightly altered. The revised model offers modified calculations for the Total Staking Factor, a crucial component when determining the amount of USDC rewards that will be allocated to you on a weekly basis.

As stated earlier, the longer you lock up your tokens, the higher your rewards will be. Let's explore how this works with the upgraded formula:

Total Staking Factor = 1+ New Time Factor + Trading Activity Factor

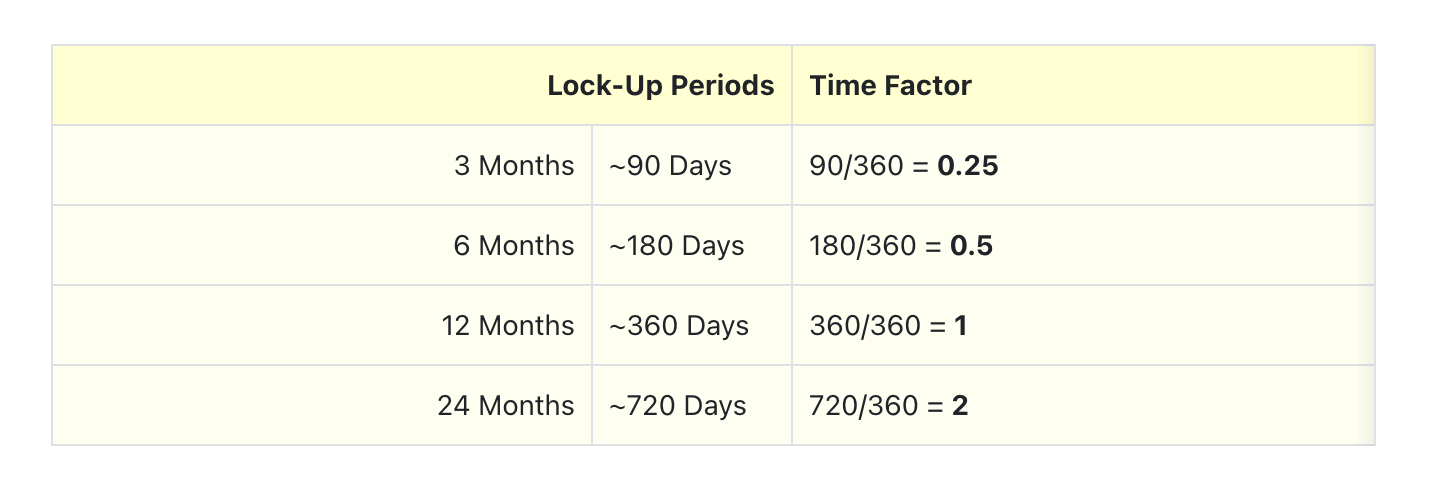

New Time Factor: This factor is calculated based on the chosen lock-up period and returns to 0 after the lockup period expires*.

New Time Factor = Lock-Up Period (Months) / 12 Months

Trading Activity Factor: This factor is calculated based on your trading activity. The more days you trade in a week, the higher your trading activity factor. For instance, trading one day of the week results in a trading activity factor of 0.1, while trading 4 times per week gives you the factor worth 0.4. The factor increases by a constant linear amount (0.1) for each additional day traded in a week, up to 5 days.

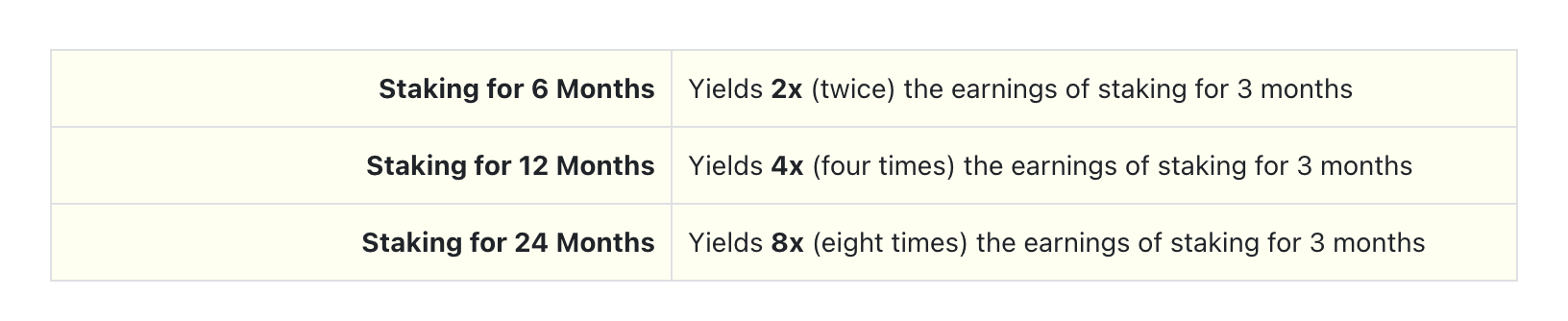

The longer your chosen lock-up period, the higher your USDC allocation.

Without considering the Trading Activity Factor, here's how different Lock-Up durations compare in terms of earnings:

For a more an in-depth explanation of how staking rewards are calculated and examples, please refer to our Gitbook.

Please note, with Staking 3.0, selecting a lock-up period is a key component of the staking process. Once the lock-up period expires, you have to re-stake the tokens and choose a new term, to prevent the time factor on your staked positions from dropping to 0.

Existing Staker Guidebook!

If you're already part of our Staking Program, here's what you need to know!

You'll have 1 month after the launch of Staking 3.0 on March 7, 2024, to unstake and restake your tokens to prevent the time factor on your staked positions from dropping to 0. March 7, 2024 onwards, the time factor will be decreasing day by day with linear reduction mechanism, eventually reaching 0.

It's recommended to unstake your Original Staked Positions as soon as possible once the Staking 3.0 goes live. Then, open corresponding Locked Staked Positions with your selected Lock-Up term.

Introducing Staking 3.0 represents a milestone in our ongoing efforts to enhance APEX Tokenomics, aimed at delivering greater value to our community via our revenue-sharing program.

Keep an eye out for further updates, and happy staking!