Threats are ever-evolving on the virtual plane — and that's why ApeX Pro is committed to continuously expanding its security provisions to better safeguard trading for all ApeXers. We continue to stay focused on ensuring the accuracy of trades, which is why we have partnered with crypto market research and analytics platform X-explore to detect wash trading and Sybil attacks on ApeX Pro.

What is Wash Trading?

One of the measurements of an exchange's market depth, liquidity and overall trading platform health is trading volume. Wash trading, which is where an investor (or more parties) execute the buying and selling of the same order(s) on a single platform, is one of the methods used by some individuals to inflate trading volume numbers. These buy and sell orders tend to be similar in quantity, price and size in opposite directions, and are placed and filled at almost the same time.

An intentional trading behavior that artificially increases a trader's account at negligible costs, wash trading generates fake market depth and may expose traders to the illusion of a particular asset experiencing foundationally strong and sustained gains.

Wash trading has been prevalent not just on crypto exchanges, but traditional financial markets too; and while the latter is being overseen by financial regulatory bodies in various countries, there are currently insufficient guidelines over detecting and eliminating wash trading on crypto exchanges.

What is a Sybil Attack?

A Sybil attack is when an individual or single entity sets up multiple dishonest nodes, accounts or addresses to engage in a fraudulent or malicious act, such as bulk-account registrations, the mass farming of rewards or wash trading. For example, a single entity may control 20 accounts (or more) to perform single-account wash trading in a Sybil attack to receive multiple rewards.

This will lead to disproportionate distribution of rewards, especially in cases where a prize pool is limited and split amongst qualified participants. In the case of events such as Trade-to-Earn, honest ApeX Pro traders are thus forced into a disadvantageous, unfair position where they are not equally rewarded for their trading efforts.

Detecting and eliminating the instances of Sybil attacks prove to be challenging, as the influx of data involved on exchanges and networks is inarguably immense. To ensure accurate and timely detection, the swift collection and analysis of data are paramount.

Creating a Safer Environment for ApeXers

Currently, the key to reducing and eliminating wash trading and Sybil attacks lie in three critical propositions:

Accurate collection of on-chain transaction data

Reliable data analytics derived from experts and artificial intelligence

In-depth understanding of fraud strategies specific to Web3

Under X-Explore's watchful eyes, ApeX Pro traders can trade with peace of mind, knowing that trading volumes and trades are as accurate and transparent as they can be.

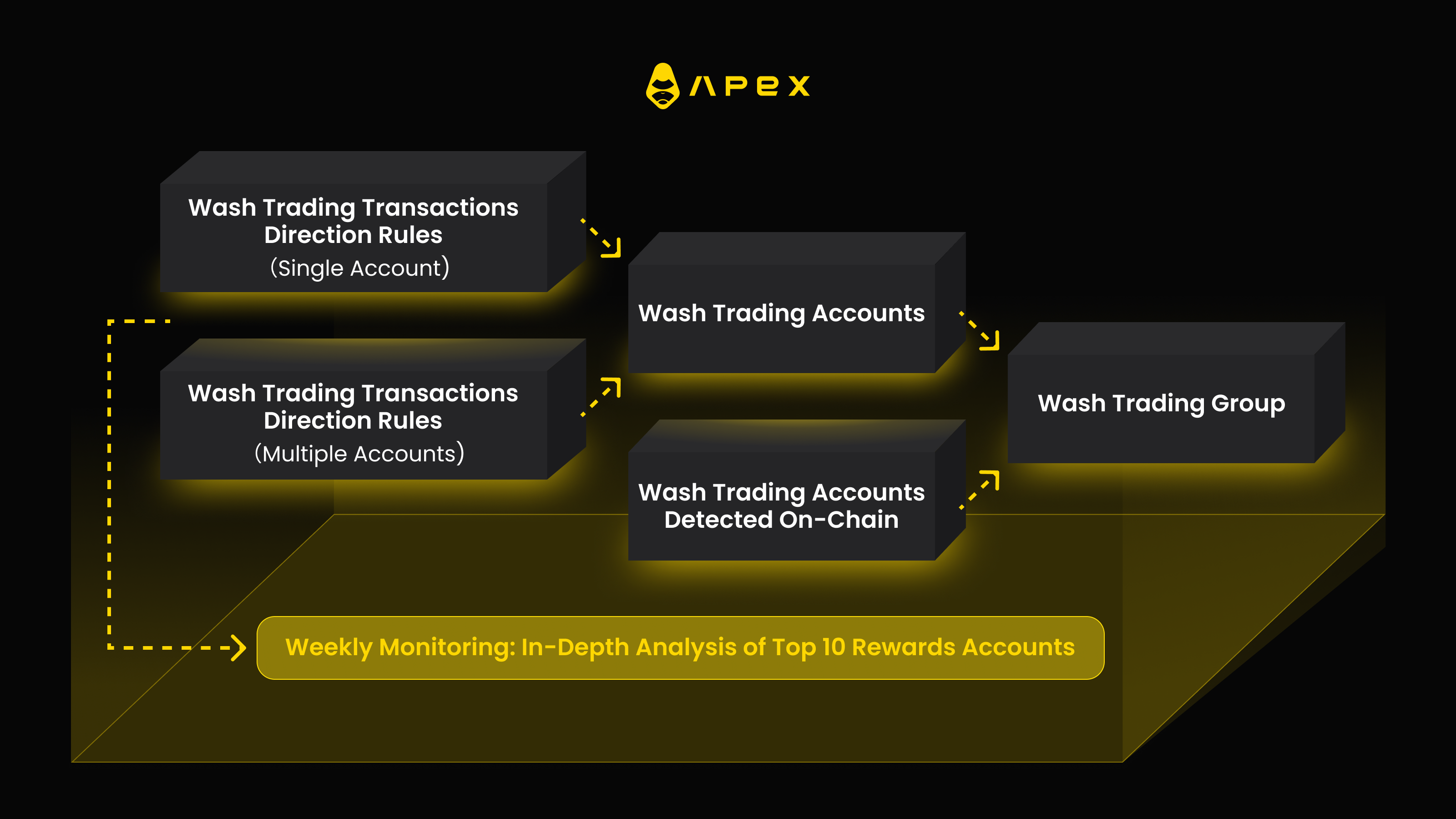

Here's a brief visual flowchart to show how the detection process pipeline will be:

(1) Wash Trading Detection

Step 1: Rules for wash trading transactions are set for single and multiple accounts, focused on identifying transaction time, volume, price, size and more.

Step 2: Once accounts' trading behaviors match the rules set, they are classified as wash trading accounts and will be flagged

Step 3: We are on the lookout for bigger wash trading groups that will also include those who are involved as Sybil attackers (see the next section)

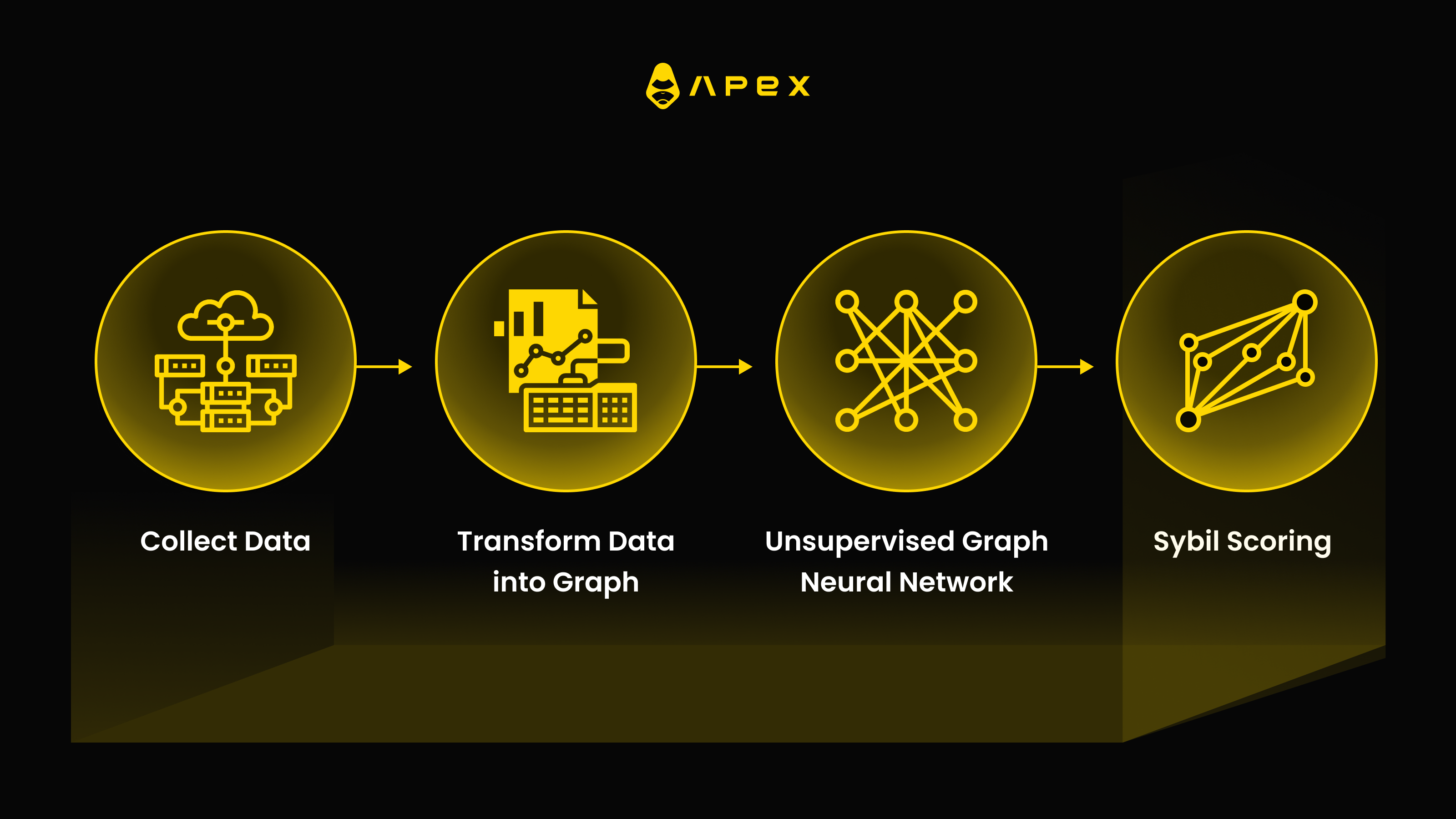

(2) Sybil Detection

Step 1: Data is collected from explorers, in this case Etherscan.

Step 2: The collected transaction data is transformed into a graph where it is compressed, allowing huge amounts of data to be successfully and efficiently processed within a short period of time. The topology of the graph will also be utilized.

Step 3: A Graph Neural network (GNN) is trained based on the topology of the graph to generate the embedding for each node address.

Step 4: Finally, transaction values, transaction time, and transaction gas fees are introduced to evaluate if there are any signs of clustering within the community. Clusters will be further examined to determine if they are indeed Sybil groups.

(3) FAQs

Why is wash trading not permitted on ApeX Pro?

Wash trading generates artifical numbers without contributing to market depth, which is unhelpful for our traders and may lead to them receiving inaccurate market signals for their next trade.

Is it possible for me to engage in wash trading unintentionally?

Wash trading is an intentional act. Accounts with a majority of their recorded trading volume identified as wash trades are flagged as wash trading accounts.

What if I have two accounts on ApeX Pro that have orders submitted in opposite directions?

You may hedge two accounts (that are not identified as wash trading accounts) against each other on ApeX Pro, as long as they are not trading directly against each other.

How will I know if my account has been flagged?

More details will be shared once wash trading detection has been fully implemented. Stay tuned to our social media channels to get our latest updats.

For more questions, please check out ApeX Pro's Discord channel support.

About X-explore

X-explore is an on-chain data analysis team that provides risk analysis solutions for Web3 projects and exchanges. X-explore has been active in Web3 and has given attack warnings on multiple notable occasions, including the gas theft attacks on FTX and more.