Update: Please note, as of Oct 8 2024, the total supply of $APEX has been reduced from 1B to 500M tokens (check the transaction here). The decision about the token supply reduction was made earlier that same year as a strategic move to enhance scarcity and boost the value proposition of $APEX, while offering benefits to the community of contributors and platform users. According to the plan, consecutive token burns are scheduled for the first month of each quarter. Read more here.

The $APEX token powers the ApeX Protocol, a decentralized network that is leading the charge on shaping a free and open ecosystem for all users to grow their wealth in a safe and trusted environment, where they can participate within an interconnected metacommunity.

The $APEX token is central to the ApeX Protocol, mainly facilitating revenue distribution via the ApeX Staking Program, where stakers of $APEX/$esAPEX tokens earn weekly rewards. Furthermore, the token is poised to be a key player in the protocol's governance, influencing the roadmap and settings, highlighting a dedication to decentralization and the active participation of the community in guiding the protocol's future trajectory.

$APEX Tokenomics Summary

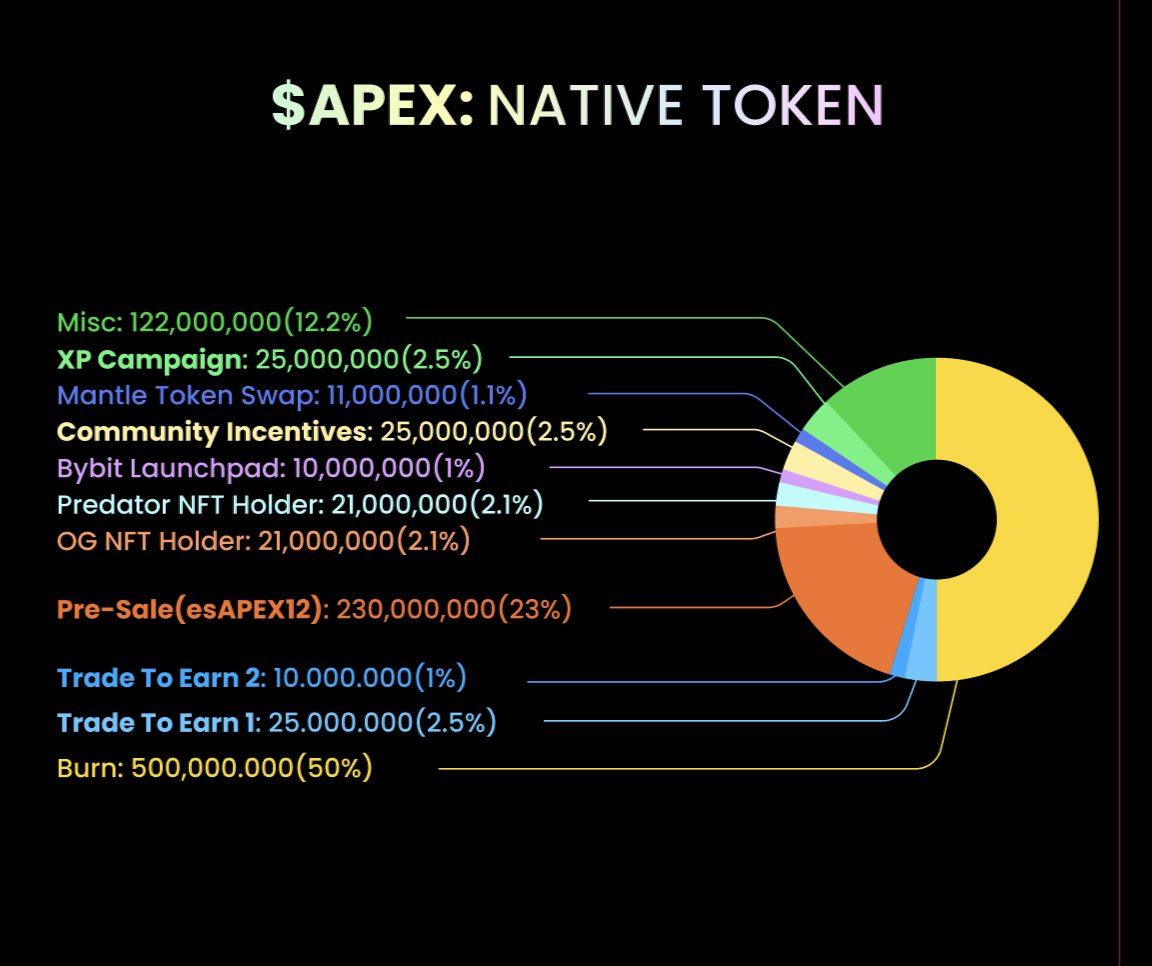

Total supply of 500,000,000 $APEX tokens (following the finalized quarterly burn held in 2024, reducing supply from 1B to 500M tokens)

23% allocated to the core team and early investors with a 24-month cliff and a vesting period of 24 months

77% for participation rewards, ecosystem building and liquidity bootstrapping where it is 100% unlocked for TGE, but tokens allocated to the DAO will be locked for 36 months.

25,000,000 $APEX and 10,000,000 $APEX were allocated to our Trade to Earn Round 1 and Trade to Earn Round 2, respectively. While another 25,000,000 $APEX was allocated to the latest XP Campaign.

The $APEX token supply distribution is as follows:

The liquidity incentive, strategic DAO allocation, team, community incentives and partnerships, and Trade-to-Earn segments are self explanatory. Here's a brief refresher on the remaining segments:

Early Investors: Made up of global investors Dragonfly Capital, Jump Trading, Kronos, M77 Ventures, Mirana Ventures, Tiger Global, Cobo, and CyberX

OG and Predator NFTS: NFT offerings from the initial ApeX eAMM launch in early 2022 — for OG NFTs in particular, there are a total of 20 holders. In total, they will receive an allocation of approximately 1,041,666 $APEX each, locked for the first six months following the TGE and linearly vested on a monthly basis thereafter.

Please note that the monthly token distribution for OG NFT holders has changed from $APEX to $esAPEX as of February 2023.

$esAPEX is an escrowed version of $APEX, converting which to $APEX governance token requires six (6) months of vesting.

Bybit Launchpad: The public debut of the $APEX token via Bybit's project and token-discovery platform

BitDAO (now Mantle) Token Swap: The BIP-17 proposal on BitDAO's (now Mantle) official snapshot, which proposed for a token swap of $2M in USDC for 11M $APEX tokens