Confused about where to trade your crypto - CEX or DEX? You're not alone. As crypto adoption grows, traders are faced with a choice: use a centralized exchange (CEX) like Binance, or go decentralized with a platform like ApeX, Hyperliquid, or Uniswap.

Each option has its strengths and trade-offs. CEXs offer convenience and speed, while DEXs champion privacy and control. In this guide, we’ll walk you through the biggest differences using real-world examples and analogies, so you can decide what suits your goals best.

We’ll compare the two across key categories: Security, Fees & Speed, User Experience, Functionality, and Risks—plus a deep dive into 8 core decision-making factors.

What is a CEX?

A Centralized Exchange (CEX) is like a traditional bank or currency exchange booth. You deposit your crypto into their custody, and they handle the rest, such as order matching, execution, and security. Examples: Binance, Coinbase, Kraken, etc.

Pros:

Easy to use

High liquidity

Customer support

Fiat onramps & tools

Cons

You don’t control your funds

KYC is usually required

Vulnerable to hacks or downtime

Can freeze accounts

What is a DEX?

A Decentralized Exchange (DEX) lets you trade directly from your wallet without giving up control of your assets. It’s more like meeting a friend to swap cash in person, using technology to handle trust.

Examples: ApeX, Uniswap, PancakeSwap, dYdX

Pros

Full control of your funds

No KYC or account needed

Accessible from anywhere

More privacy and freedom

Cons

Requires basic crypto knowledge, such as how to create a wallet, deposit funds, etc.

Limited customer support, yet it varies from protocol to protocol, with protocols like ApeX having a strong customer support team via their Discord channel.

Gas fees could be costly on busy chains

Greater responsibility to manage your assets

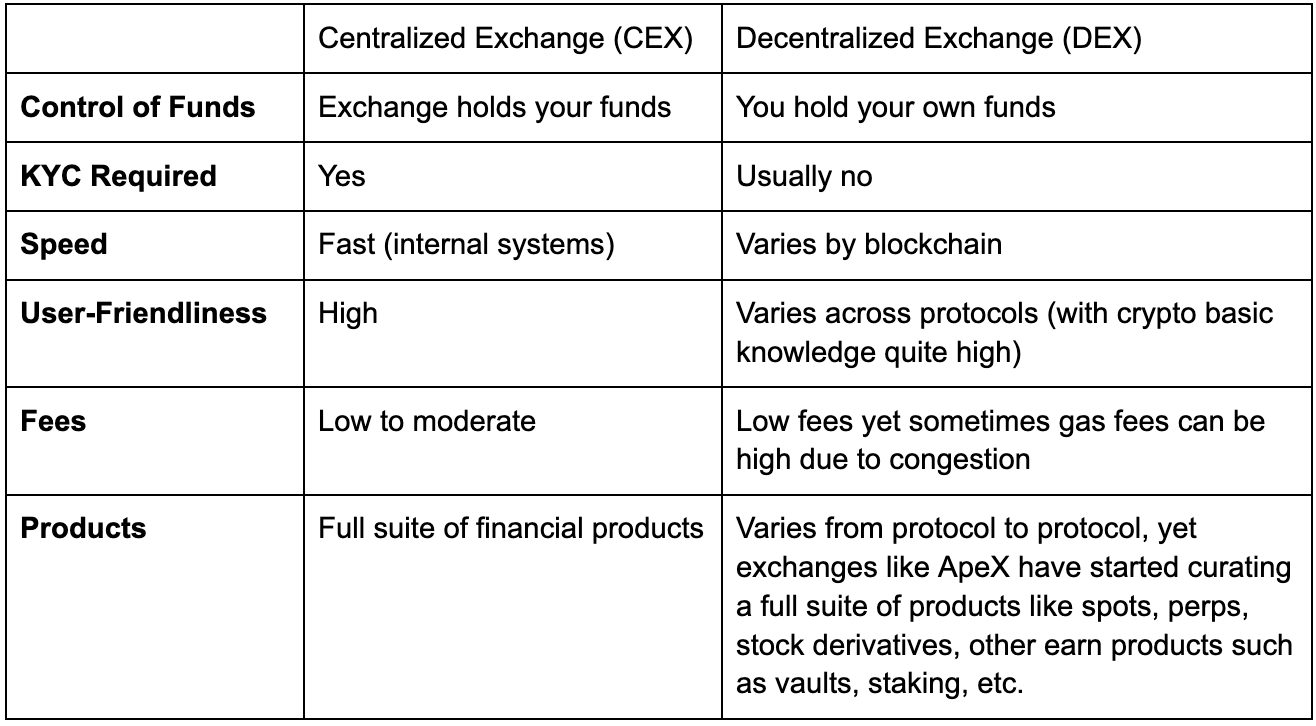

CEX vs DEX: Key Differences

“Think of a CEX like going to a bank to exchange your dollars to euros: you give them your cash, they handle the rest. A DEX is more like meeting a friend and directly swapping dollars for euros – no middleman, just trust and tech.”

CEX and DEX Breakdown by 8 Core Factors

The following categories cover what really matters when picking an exchange: safety, variety, ease of use, and legal risk. Let’s break it down.

Security

CEX: Your funds are stored in exchange wallets. If they hack or freeze your account, you could lose access.

DEX: You hold your own keys, so you stay in control. But you’re also fully responsible.

CEX = money in a bank. DEX = money in your personal safe.

Range of Cryptocurrencies

CEX: Offers popular tokens, but listings could be limited.

DEX: Supports thousands of assets, including early-stage tokens.

Liquidity

CEX: High liquidity and deep order books mean faster trades.

DEX: Popular pairs have strong liquidity, but niche tokens may sometimes suffer from slippage, however, this also varies from platform to platform, with more prominent DEXs like ApeX and Hyperliquid offering strong liquidity and low slippage.

Fees & Speed

CEX: High trading fees, usually fast execution. Fees apply to trades, deposits, and withdrawals.

DEX: Typically offers lower fees compared to CEXs, though this can vary by protocol. When network gas fees are stable, trading on a DEX often becomes more cost-effective overall. Some protocols, like ApeX, even offer gas-free trading—for instance, perpetual markets on ApeX Omni have zero gas fees, which can significantly reduce the total cost of trading.

User Experience

CEX: Known for user-friendly interfaces, intuitive charts, and customer support, making them a go-to for beginners.

DEX: Requires a Web3 wallet and a basic understanding of crypto fundamentals. While there’s a learning curve, the concepts—like wallet setup and decentralized trading—aren’t overly complex. Once users grasp the basics, DEX platforms offer a smooth and highly efficient trading experience.

Adoption Rate

CEX: Over 90M global users. Heavily adopted by institutions.

DEX: Estimated 3-5M+ users. Strong growth among crypto-natives.

Functionality

CEX: Fiat purchases, leveraged trading, spot trading, and earn products.

DEX: Peer-to-peer swaps, leveraged trading, staking, yield farming, liquidity provision, and earn products like vaults.

Risks & Regulations

CEX: Subject to government regulation; your account can be frozen.

DEX: Open and unregulated, but risk of scams, fake tokens, or loss if user errors occur.

CEX = more protection, less freedom. DEX = more freedom, more personal responsibility.

DEX Safety Tips Every User Should Know

While DEXs empower users, they also demand vigilance. Here are must-follow tips:

✅ Double-check token contract addresses

✅ Use reputable DEXs or aggregators

✅ Never share your seed phrase

✅ Watch out for fake tokens and phishing sites

✅ Use hardware wallets for extra protection

✅ Start with small amounts and build confidence

Conclusion

Whether you're drawn to the polished experience of a CEX or the freedom of a DEX, there's no one-size-fits-all answer. CEXs are great for beginners and offer strong support, but they come with trade-offs in control. DEXs put power in your hands, but you must be informed and cautious.

Our advice? Try both. Start small, understand the differences, and decide what feels right based on your goals, risk tolerance, and comfort with blockchain tools.

Ready to experience the future of trading? Explore ApeX—a decentralized platform built for control, transparency, and performance.

FAQ

Is a DEX safer than a CEX? DEXs reduce custodial risk but put the responsibility on you. CEXs offer safety nets but have custodial control.

Can I trade anonymously on a DEX? Yes, most DEXs don’t require KYC or accounts.

Do I need a wallet to use a DEX? Yes. You’ll need a Web3 wallet like MetaMask or WalletConnect.

Can CEXs be hacked? Yes. Many have been compromised in the past, though security has improved.

Which one is better for beginners? CEXs are more beginner-friendly with support and easier interfaces.

Are DEXs legal? In most regions, using a DEX is legal, but regulations vary. Always check local rules.

Jump into Our Learn & Earn Quests — Earn $100 per Quiz!

Have you been following our Learn blogs? Now it’s time to turn that knowledge into rewards! Take a quick quiz on Galxe and snag your share of $100 USDT for each quest.

Make sure your wallet is connected to ApeX Omni to claim your rewards — if you haven’t connected yet, it only takes a moment. Ready, set, earn!