ApeXers, earlier this year, we introduced esAPEX12 Strategic Solution — a sustainable approach to token unlock for the core team and early investors.

The initiative introduced a sustainable release model, designed to address challenges associated with token price volatility, market shifts, and inflation during the unlock period.

We are thrilled to announce that after thorough discussions with investors and our core team, we've reached a consensus to implement this strategy, balancing the long-term vitality of the project with the interests of all parties involved.

The implementation of the strategy starts by establishing a Bonding Curve Token Locking and Sales Pool ($esAPEX12 pool).

Let's take a closer look at what this entails and how it impacts our token holders and community members.

Background

When it comes to launching new tokens, most crypto projects stick to pre-set token release schedules as defined in their initial tokenomics model.

However, the token unlock mechanisms often run into problems like token price swings, shifts in market demand, and token inflation. These factors inevitably affect and influence the secondary token market, especially if a substantial amount of tokens are allocated during pre-sale and released at the same time frame.

With the introduction and implementation of the novel token release mechanism — esAPEX12 strategic solution, the ApeX team aims to mitigate the above mentioned issues, by allowing for the orderly and sustainable release of the pre-sale tokens, promoting a better balance of interests between the secondary market and project investors.

esAPEX12 Finalized Mechanics

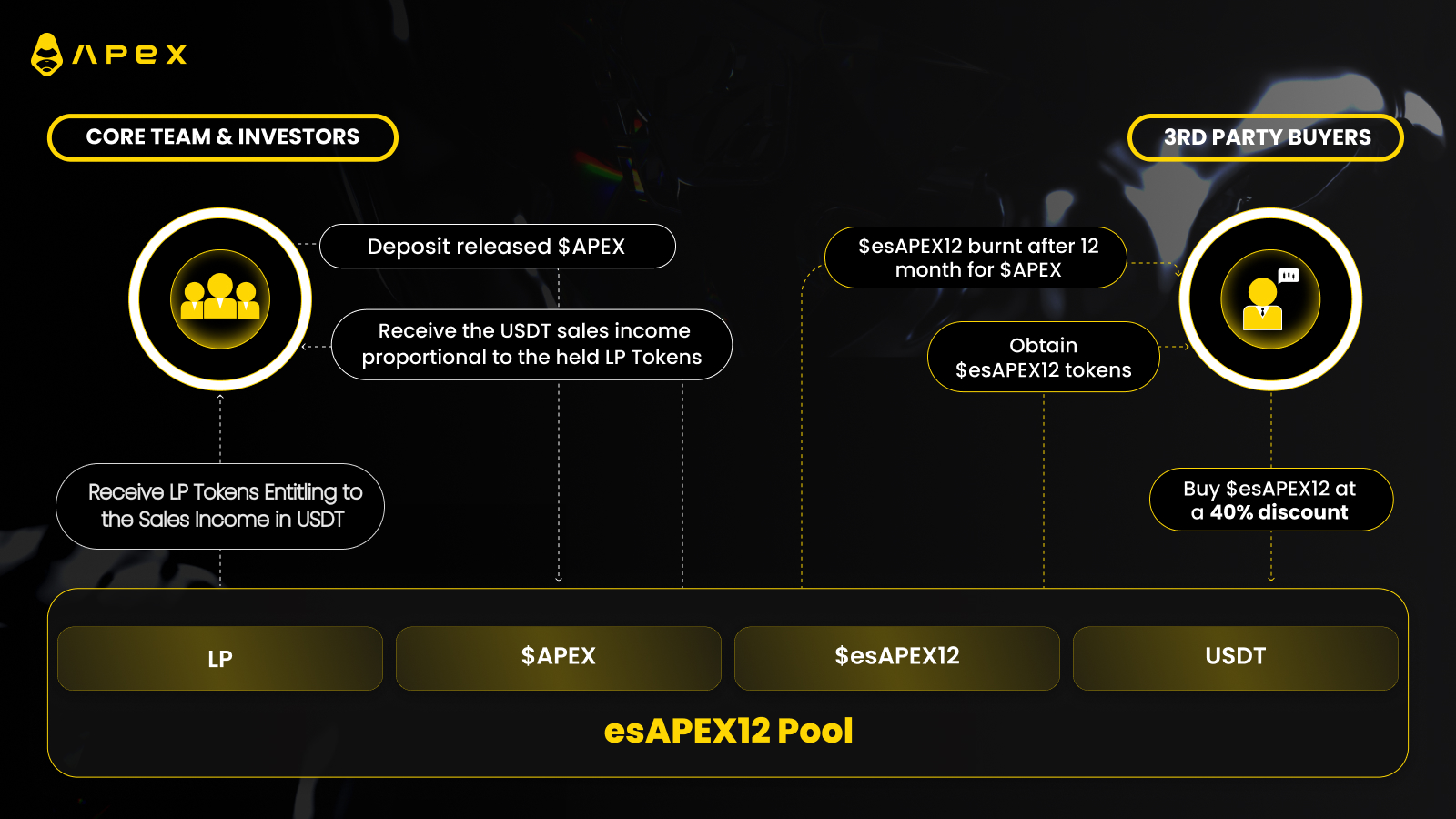

The esAPEX12 Solution establishes an esAPEX12 pool. Here, the newly released $APEX tokens for both core team members and investors will be invested and locked according to the initial unlock schedule. These locked tokens will generate $esAPEX12, which can then be sold via the same pool to any third party with a 12-month lockup period.

Upon depositing tokens in the esAPEX12 pool, investors and core team members will receive LP tokens based on their initial investment ratio. These tokens will represent their right to receive sales income from $esAPEX12 in USDT. LP tokens cannot be exchanged back for $APEX tokens; they solely entitle holders to income from token sales.

The pool will release $esAPEX12 at a fixed rate of 1:1 to $APEX daily, and the monthly availability of $esAPEX12 for sale will not exceed the initially planned unlock quota for that month, ensuring controlled token supply.

As shown in the diagram below, the third party purchasers will be able to buy $esAPEX12 tokens at a discounted rate of 40%. Following the mandatory 12 month lock-up period, they can withdraw their $esAPEX12 allocation and burn them to recieve $APEX.

While the esAPEX12 strategy promises to bring a sustainable solution to the token unlock model, it is still considered to be an experimental approach. With that in mind, the parties involved have agreed on the following:

The ApeX team will not take any sales income until the early investors claim their initial investment amount fully. Consequently, any sales profits from the team's token allocation in the pool will be manually transferred to the investors.

On the other hand, in the unlikely scenario that there is no buying demand for $esAPEX12, there will be an LP exit function introduced. This function will allow the team and core investors to engage in a soft governance process to determine whether to terminate the esAPEX12 strategy and revert it to the original vesting schedule.

Closing Thoughts

The esAPEX12 solution is designed to manage the challenges associated with the pre-sale token releases, such as price volatility, shifts in market demand, and inflation, while considering the interests of both secondary markets and project investors.

By locking the releases $APEX tokens and issuing $esAPEX12 at a controlled rate, this approach moderates the influx of new tokens into the market and helps mitigate potential negative impacts on the price of $APEX, thereby supporting the project's long-term vitality and safeguarding investor interests.

In addition to creating esAPEX12 pool, we also have implemented a strategy to revamp $APEX tokenomics with quarterly token burns. These burns play a crucial role in aligning the token's value with that of the project, while enhancing benefits for our community and token holders. With these 2 initiatives of moderating the release of new tokens and strategically reducing the total supply, we are creating a more stable and robust ecosystem.

For all the details on the quarterly burns of $APEX and how they contribute to our long-term objectives, be sure to check out our blog.