ApeX Pro is bringing ApeXers a freshly-minted yield-generating product. Introducing the Smart Liquidity Pool, an exclusive liquidity pool that gives any trader on ApeX Pro instant access to market-making strategies and earnings without the complication of learning the ins-and-outs of market-making, a trading approach that expert traders usually engage with. This can be done without large amount of funds as well; any ApeXer can participate with smaller capital sizes.

Opening Access to Advanced Market-Making Strategy for All

The Smart Liquidity Pool allows any trader, from the crypto curious to the seasoned crypto pundits, to easily dip into potential gains generated from market-making. The pool leverages advanced automated algorithms and trading signals to quote optimal prices and continually adapts to real-time market conditions to provide enhanced liquidity, plus remarkably high and stable returns, for ApeX Pro traders. And unlike typical market-making strategies and vault offerings in the existing market, the Smart Liquidity Pool is optimized to trade a large volume of spreads, while avoiding adverse positions with advanced signals and risk management.

The key features of the pool include:

Access to market-making strategies by simply allocating traders' funds (a minimum of 100 USDC) to the pool

Automated trading algorithms to execute trades and take advantage of split-second market opportunities any day, at any time

Robust security measures to protect ApeXers' assets from malicious online attacks

High liquidity provision on the ApeX Pro trading platform, with increased order book depth and significant slippage reduction for users

By providing liquidity to ApeX Pro via the Smart Liquidity Pool, ApeXers can now diversify their trading portfolio and take their yield-maximizing strategy to the next level.

What are the Risks Involved?

Certainly, any trading strategy comes with its fair share of risks, including but not limited to:

Position Loss: Positions could accumulate within the pool as the prices of assets fluctuate, leading to position loss if the assets' prices change rapidly in an unfavorable direction. This could result in a loss of the pool's net value, which is calculated as Total Value Locked (TVL) * Value of a Share within the pool.

Entry & Exit: Slippages can occur when entering or exiting the pool and conditions may be exacerbated in extreme market conditions.

The Smart Liquidity Pool is no exception, but what makes it a cut above existing liquidity pools or vaults in the market, is that it has been designed to minimize the above-mentioned risks significantly. Compared to typical Automated Market Maker (AMM) pools or vaults that rely on a fixed formula without room to adjust to actual market conditions, the Smart Liquidity Pool employs statistical models to monitor portfolio performance and predict market conditions to determine the optimal prices to quote. It has less exposure to risky assets such as BTC and ETH, while also providing higher capital utilization without running the risk of increased impermanent losses.

The Specs: How to Access the Smart Liquidity Pool

All users need to do is deposit 100 USDC into the Smart Liquidity Pool to earn a share of the profits generated by market-making activity. The pool is a secure, transparent, and automated way to earn higher yields on your deposited assets.

Subscribe

Total Value Locked (TVL) = Total Amount of USDC* in the pool

*amount allocated by subscribers + profits made by MM strategy

Total Pool Shares = TVL/Value of a Share

Total Pool Shares = Total Value Locked (TVL) before the SLP MM Strategy starts earning profits.

You will be able to see your total Pool Shares after selecting the amount of USDC you would like to deposit into the pool. Once you have successfully subscribed to the pool, you will start accumulating yield.

Withdraw

Total Amount Received = User's Pool Shares * Value of a Share at Withdrawal

Select the total amount of Pool Shares you would like to withdraw. Your total yield amount will depend on the exchange rate at the time of the withdrawal, which is calculated as Value of a Share (see the formula above).

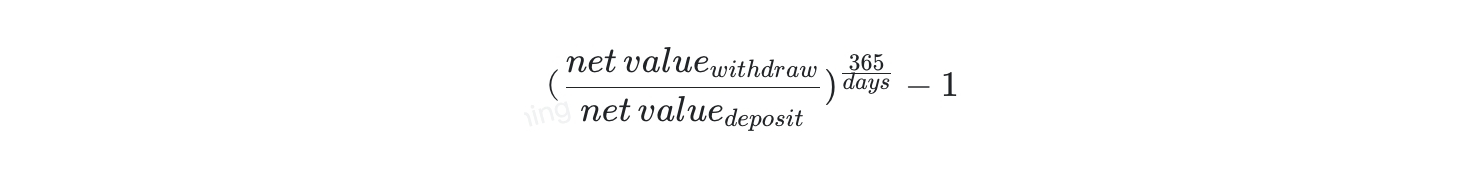

User's Yield (APY)

Subscription to the pool is settled on a daily basis and thus, the yield is calculated also on a daily basis and is reinvested automatically to generate multiplied yield for ApeXers.

Therefore, the minimum lockup period for your deposited USDC is one (1) day. For example, if you subscribe to the pool anytime on a specific day, your earnings will be settled uniformly the next day at 4AM UTC.Once the settlement time is reached, you will be able to withdraw your earnings, settled in USDC.

*Note: The yield as displayed per pool is benchmarked based on Real Yield calculations, and is automatically compounded for higher returns.

To begin, ApeXers will need to first transfer their funds from their wallet to their ApeX Pro account. Please note that there will be zero fees incurred for subscribing to and withdrawing from the Smart Liquidity Pool in the first phase of the launch.

For an example of how this will play out with exact calculations, check out our Gitbook.

Get started with the Smart Liquidity Pool today.